Rumored Buzz on Esg

Table of ContentsUnknown Facts About EsgGetting My Esg Strategy To WorkGet This Report on Esg InvestingEsg Strategy Fundamentals Explained

Why do particular financial investments do better than others? Why do specific startups appear to constantly surpass as well as obtain ahead of the associate? The answer has 3 letters, and it is Whether you are a financier or a company, huge or tiny - Environmental, Social and Administration (ESG) reporting and investing, is the framework to catch on if you intend to stay up to speed up with the market (and also your bill) - ESG Investing.Now, allow's study the ESG topic as well as the excellent value that it has for firms as well as capitalists. To help investors, economic institutions, and also firms understand much better the underlying standards to apply and report on them, we developed a. Download and install the form below as well as gain access to this special ESG source absolutely free.

Financiers would like to know if they can trust the business as well as what kind of choices are taken behind shut doors. It consists of executive pay, gender equity/ equal pay, bribery and corruption, as well as board diversity. The technique of ESG investing began in the 1960s. ESG investing progressed from socially liable investing (SRI), which omitted supplies or entire markets from financial investments connected to business operations such as tobacco, guns, or products from conflicted regions.

Components of it are reliable from March 2021. The goal is to reorient resources flows in the direction of sustainable financial investment as well as away from sectors adding to environment modification, such as fossil fuels.: is arguably the most ambitious message aiming to offer a non-financial general rating covering all facets of sustainability, from ESG to biodiversity and also pollution therapy.

The 8-Second Trick For Esg

You rather leap on this train if you do not desire to be left behind. For firms to stay in advance of guidelines, competition as well as let loose all the benefits of ESG, they must integrate this structure at the core of their DNA.

(ESG) concerns are playing a raising duty in companies' choices around mergers, acquisitions, and also divestitures. But just how do these variables link to company performance as well as deal potential? In this episode of the Inside the Strategy Space podcast, 2 experts share their insights on navigating this fast-changing landscape. Sara Bernow, who leads Mc, Kinsey's work in sustainable investing and co-leads the institutional investing technique in Europe, is a co-author of the recent short article, "Greater than worths: The values-based sustainability reporting that financiers desire." Robin Nuttall leads our regulative as well as government affairs method as well as lately co-authored "Five means that ESG creates value." They talked to Approach & Corporate Finance communications director Sean Brown at the European 2020 ESG Investing M&A Conference in London, which was hosted by Mc, Kinsey and Goldman Sachs.

Sound Why ESG is here to stay Sara, could you start by clarifying what ESG is and why it has increased in significance in M&A? ESG is fairly a broad set of concerns, from the carbon dioxide footprint to labor techniques to corruption.

Not known Incorrect Statements About Esg

They connect with each other in the feeling that the setting, the social variables, and also the level to which you have great administration impact your certificate to run as a business within the exterior globe. To what degree do you manage your environmental impact? That has an influence on your permit to operate in the minds of the stakeholders around you: regulators, governments, and also significantly, NGOs powered by social media.

Consumers are currently demanding high criteria of sustainability as well as quality of work from companies. Regulators as well as plan makers are extra thinking about ESG because they need the company industry to aid them address social issues such as ecological air pollution as well as workplace diversity (ESG Strategy). The investor neighborhood has actually likewise come to be much extra interested.

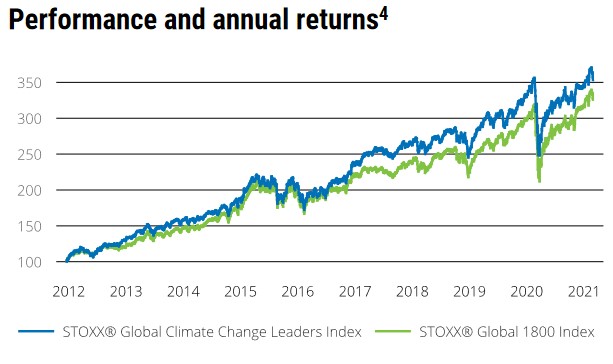

Taking an industry-by-industry lens is crucial and also we currently see ESG-scoring firms constructing deeper industry-specific perspectives. What are a few of the crucial elements on which ESG ratings have an influence? The initial question you require to address is, to what level does good ESG convert right into great economic efficiency? On that, there have actually been greater than 2,000 academic studies and also around 70 percent of them find a positive partnership in between ESG ratings on the one hand and also monetary returns on the various other, whether determined by equity returns or earnings or evaluation multiples.

The Greatest Guide To Esg Strategy

Evidence is emerging that a much better ESG score converts to about a 10 percent reduced price of capital as the dangers that influence your organization, in regards to its certificate to run, are decreased if you have a solid ESG suggestion. Proof is arising that a far better ESG score translates to regarding a 10 percent lower cost of funding, as the dangers that influence your service are lowered.

Comments on “What Does Esg Do?”